You are given the following information concerning two stock

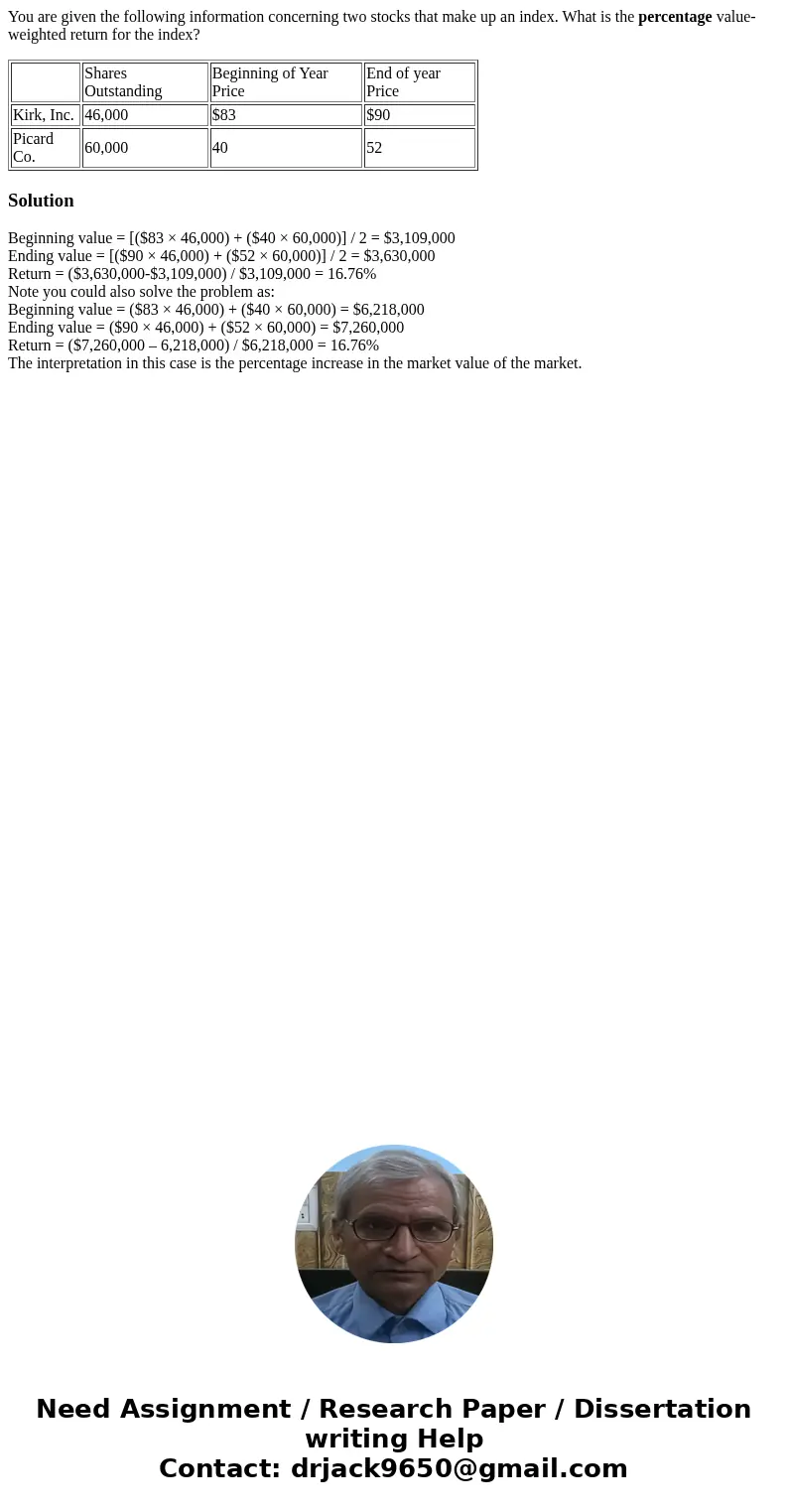

You are given the following information concerning two stocks that make up an index. What is the percentage value-weighted return for the index?

| Shares Outstanding | Beginning of Year Price | End of year Price | |

| Kirk, Inc. | 46,000 | $83 | $90 |

| Picard Co. | 60,000 | 40 | 52 |

Solution

Beginning value = [($83 × 46,000) + ($40 × 60,000)] / 2 = $3,109,000

Ending value = [($90 × 46,000) + ($52 × 60,000)] / 2 = $3,630,000

Return = ($3,630,000-$3,109,000) / $3,109,000 = 16.76%

Note you could also solve the problem as:

Beginning value = ($83 × 46,000) + ($40 × 60,000) = $6,218,000

Ending value = ($90 × 46,000) + ($52 × 60,000) = $7,260,000

Return = ($7,260,000 – 6,218,000) / $6,218,000 = 16.76%

The interpretation in this case is the percentage increase in the market value of the market.

Homework Sourse

Homework Sourse